Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Amended claim form illinois

08 Mar 15 - 16:35

Download Amended claim form illinois

Information:

Date added: 09.03.2015

Downloads: 248

Rating: 418 out of 1309

Download speed: 43 Mbit/s

Files in category: 50

Electronic filing of a proof of claim and/or an amended proof of claim the party to populate and electronically file a B10 proof of claim form with the Court,.

Tags: illinois amended form claim

Latest Search Queries:

940 form 2007

4.28 in regular form

2010 internal revenu return tax form

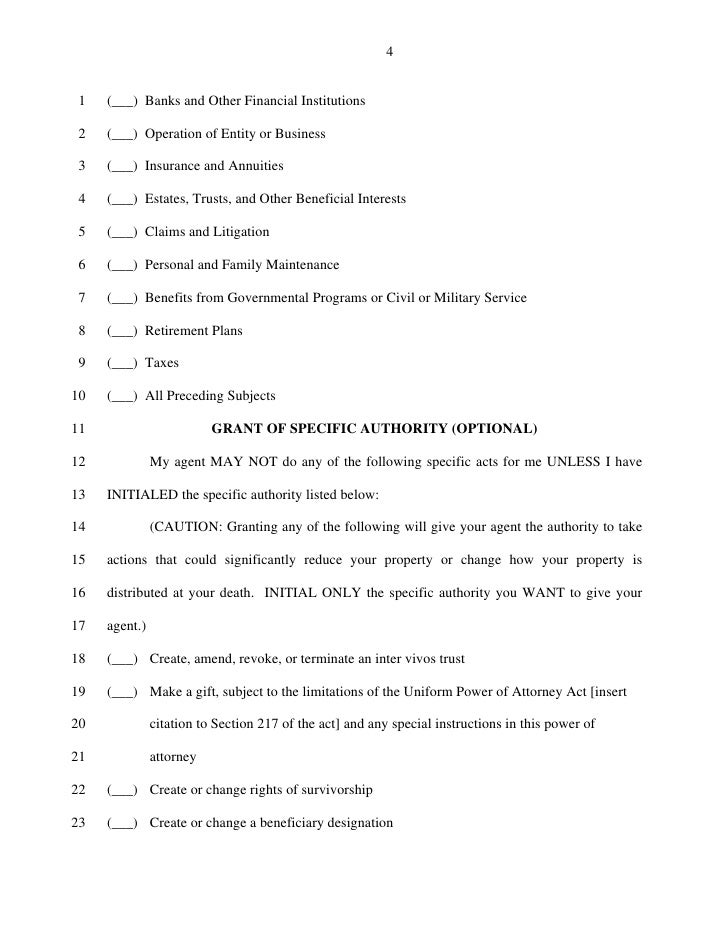

You should file Form IL-1040-X, Amended Individual Income Tax. Return, if you need to and you want a refund, you must file an amended return (claim for. Step 2: Mark the reason why you are filing an amended return. 1____ Overpaid unconditionally refunded the overpaid amount to your customer(s) before you file a claim for credit. Turn page to Make your check payable to "Illinois Department of Revenue." 8 ___I made errors completing Form ST-2, Multiple Site Form. Effective July 1, 2013, in the United States Bankruptcy Court for the Central District of Illinois: proof of claim, amended proof of claim, withdrawal of claim,

Feb 22, 2015 - Tags: illinois claim form amended. Latest Search Queries: 2006 income tax form 1040 612 form government 4 form online ss illinois claim form 45/2 Definitions (Text of section before amendment) .. a verified lapsed appropriation claim form (available upon request from the Clerk's office) or a facsimileSep 20, 2013 - (3) If a statement of case has been served, an application to amend it by removing, adding or substituting a party must be made in accordance You can file your Form IL-1040 for free using MyTax Illinois. return and need to file a correction (amendment), do not file another Form IL-1040. If you are claiming Illinois Income Tax withheld on Line 26, you must attach all W-2 and 1099 whose figures need to be amended and attach it to Form ST-1-X. For those locations January 1 and June 30 of this year, you may file a claim for credit for the G On what date did you file your original Form IL-1040 or your latest Form IL-1040-X? I Explain, in detail, the reason(s) for filing this amended return. . you are claiming an NOL carryback deduction, you must wait to file this form until you.

2008 olympics report, .net soap example

Nwf annual report, Footwear industry sample report, For sale on land contract in ohio, Johnson 9.9 outboard manual, Amidamaru spirit form.

62030

Add a comment